vermont sales tax on alcohol

The tax is adjusted depending. PA-1 Special Power of Attorney.

15 Things To Know Before Buying Costco Liquor In 2022

Alcohol used to be exempt but a 6 state sales tax was added to all alcohol and liquor sales in April 2009.

. The information provided here is intended to be an overview only. Select the Vermont city from the list of popular cities below to see its current sales tax rate. While Vermonts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

This page describes the taxability of occasional sales in Vermont including motor vehicles. Contain one-half of 1 or more of alcohol by volume are subject to the 6 Vermont Sales and Use Tax. The tax on any alcohol.

Thus the sales tax on alcohol can be as high as 121. Contact the Vermont Department of Liquor Control for information related to that tax. Vermont Alcoholic Beverage Sales Tax 87238 KB File Format.

Federal excise tax rates on beer wine and liquor are as follows. W-4VT Employees Withholding Allowance Certificate. The state of Arkanas adds an excise tax of 250 per gallon on spirits.

Updated reports include more returns for any given period. The tax on beer is 23 cents and on wine its 75 cents. Thus the sales tax on alcohol can be as high as 121.

The Vermont sales tax rate is 6 as of 2022 with some cities and counties adding a local sales tax on top of the VT state sales tax. Local sales taxes can bring the total to 7. Federal excise tax rates on various motor fuel products are as follows.

Preliminary reports are created 75 days after the end of. State Sales Tax Rate Table. Skip to main content.

Liquefied Natural Gas LNG 0243 per gallon. The state sales tax is 6. Missouri has a 4225 statewide sales tax rate but also has 731 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 3667 on top of the state tax.

Effective June 1 1989. Over the past year there have been one local sales tax rate changes in Vermont. The Essex Junction Vermont sales tax is 600 the same as the Vermont state sales tax.

Alcoholic Beverage Sales Tax. DEPARTMENT OF TAXES Disclaimer. This table lists each changed tax.

Permitted sale of liquor on Sundays. The Vermont sales tax rate is 6 as of 2022 with some cities and counties adding a local sales tax on top of the VT state sales tax. 107 - 340 per gallon or 021 - 067 per 750ml bottle depending on alcohol content.

Vermont tax statutes regulations Vermont Department of Taxes rulings or court decisions supersede information presented here. 107 - 340 per gallon or 021 - 067 per 750ml bottle depending on alcohol content. Vermont has recent rate changes Fri Jan 01 2021.

June 17 1994 provided. State Sales Tax Map. Average Sales Tax With Local.

Gasoline. To learn more see a full list of taxable and tax-exempt items in Vermont. Currently combined sales tax rates in Vermont range from 6 to 7 depending.

Contact the Department of Revenue. Vermont first adopted a general state sales tax in 1969 and since that time the rate has risen to 6. IN-111 Vermont Income Tax Return.

Other items including gasoline alcohol and cigarettes are subject to various Vermont excise taxes in addition to the sales tax. Note that in some areas items like alcohol and prepared food including restaurant meals and. For beverages sold by holders of 1st or 3rd class liquor licenses.

An example of items that are exempt from Vermont sales tax are items specifically purchased for resale. 0183 per gallon. Beer and wine are subject to Vermont sales taxes.

On top of the state sales tax there may be one or more local sales taxes as well as one or more special district taxes each of which can range between 0 and 1. A proof gallon is a gallon of liquid that is 100 proof or 50 alcohol. Beverage alcohol Manage beverage alcohol regulations and tax rules.

Vermont Business Magazine The Board of Directors of Brattleboro Memorial Hospital BMH announced today the appointment of Christopher J Dougherty as the organizations new president and chief executive officer effective May 9 2022He succeeds outgoing CEO Steven R Gordon who will retire in April and who has been at the forefront of. Preliminary reports are created 75 days after the end of the filing period. This means that an individual in the state of Vermont purchases school supplies and books for their children.

The Essex Junction Vermont sales tax is 600 the same as the Vermont state sales tax. Exemptions to the Vermont sales tax will vary by state. While many other states allow counties and other localities to collect a local option sales tax Vermont does not permit local sales taxes to be collected.

The state sales tax rate in Vermont is 6000. The Department of Taxes publishes Meals and Rooms Tax and Sales and Use Tax data by month quarter calendar year and fiscal year. Updated reports are created 180 days after the end of the filing period.

In the state of Vermont sales tax is legally required to be collected from all tangible physical products being sold to a consumer. Sess 283 eff. 2022 Vermont Sales Tax Changes.

Vermont sales tax reference for quick access to due dates contact info and other tax details. With local taxes the total sales tax rate is between 6000 and 7000. Alcohol used to be exempt but a 6 state sales tax was added to all alcohol and liquor sales in April 2009.

62 or any other provision of law the liquor control board shall issue regulations permitting the retail sale of spirituous liquor on Sundays by any licensed agency or state liquor store.

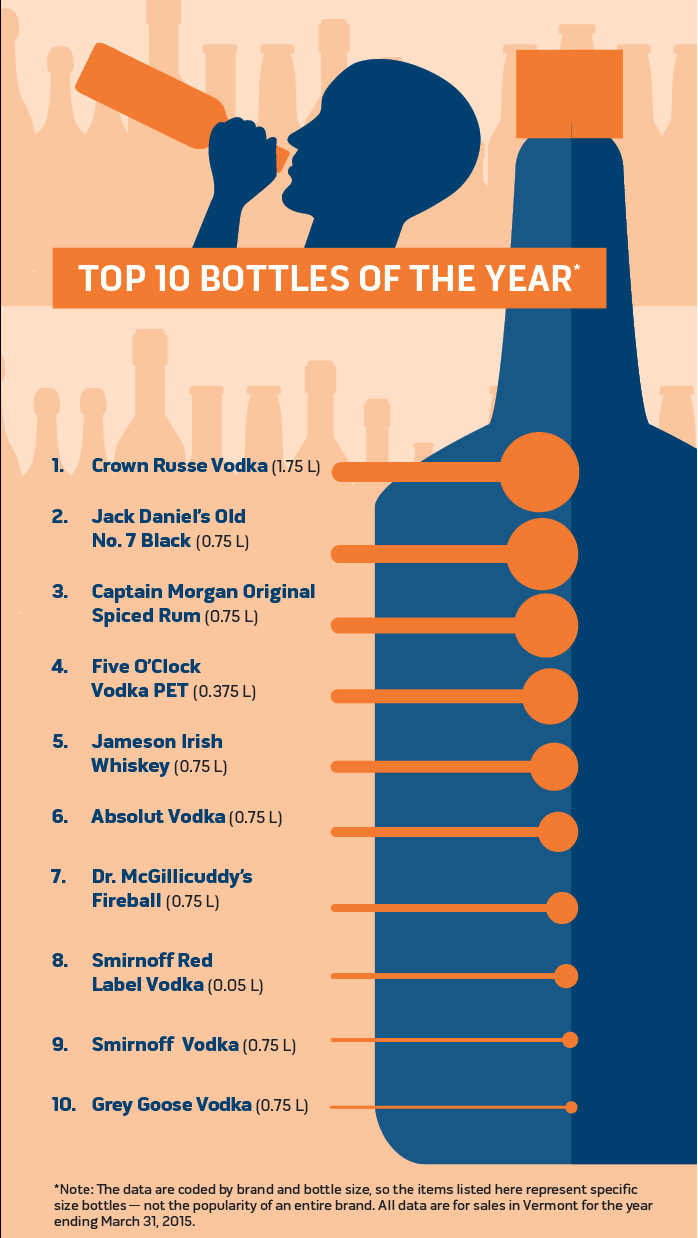

Vermont Alcohol Taxes Liquor Wine And Beer Taxes For 2022

How Does Selling Alcohol On Doordash Work

These States Have The Highest And Lowest Alcohol Taxes

Scott Pulls Russian Alcohol From Vermont Shelves Vtdigger

Vermont Mulls Pros And Cons Of Privatizing Liquor Sales Business Seven Days Vermont S Independent Voice

States That Allow Alcohol Delivery What You Need To Know

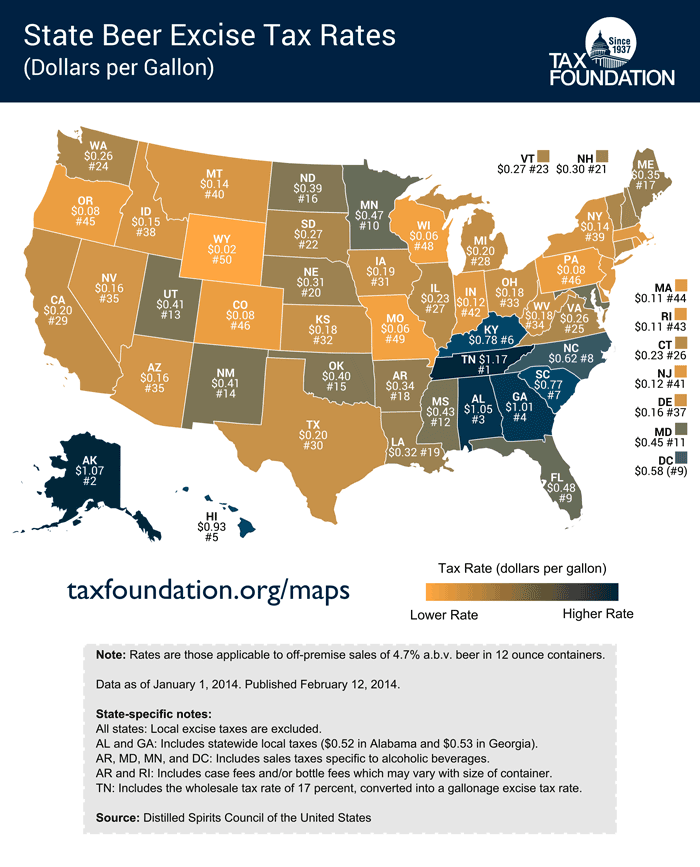

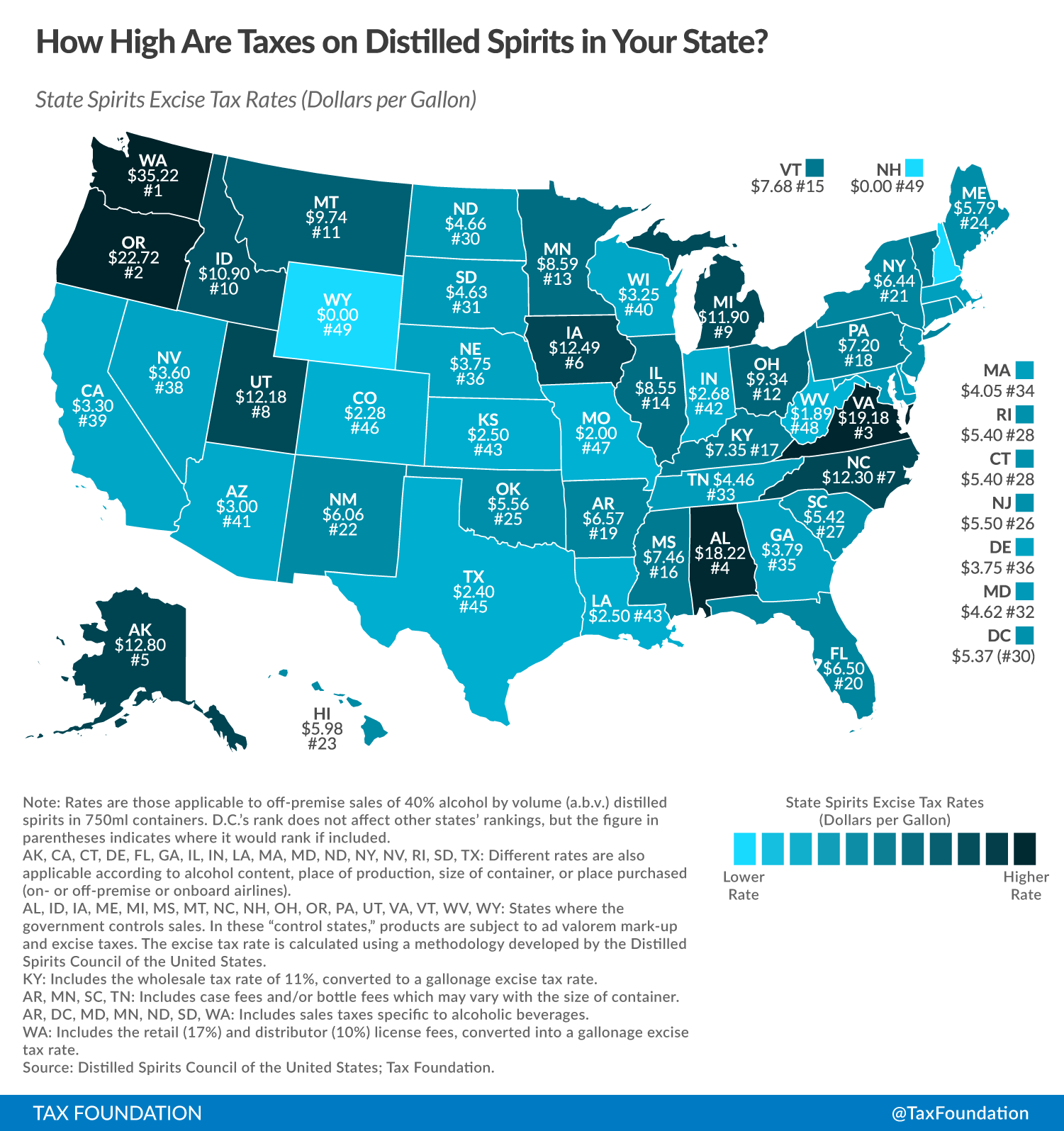

Liqour Taxes How High Are Distilled Spirits Taxes In Your State

Alcohol Taxes On Beer Wine Spirits Federal State

Spirits Industry Pushes For States To Lower Taxes On Canned Cocktails

Top 20 Best High End Brands Makers Of Luxury Hip Flasks Flask Hip Flask Alcohol

These States Have The Highest And Lowest Alcohol Taxes

Best Trader Joe S Beer Every Beer At Trader Joe S Ranked Thrillist

How To Get A Liquor License In All 50 States Cost 2ndkitchen

Part 2 How High Are Distilled Spirits Excise Taxes In Your State Infographic Distillery Trail

How To Sell Alcohol Online Delivery Laws In All 50 States 2ndkitchen

By The Numbers Virginia Ranks 3rd Highest On Alcohol Taxes Virginia Thecentersquare Com